Strategic Advisory For Investments In Infrastructure and Industrial Sectors

Corporate Finance and Strategy Experts

Specializing in corporate finance and business strategy, Bridge Factor brings decades of advisory success in M&A, project finance, and restructuring across diverse sectors. With a focus on power, renewable energy, manufacturing, and banking, our experienced team ensures unparalleled service by concentrating on a select number of transactions, fostering strong client relationships globally, including the Middle East, Europe, America, and the Far East.

We provide tailored, comprehensive solutions to an expanding portfolio across key sectors, including power generation, infrastructure, manufacturing, aviation, oil and gas, telecommunications, hospitality, real estate, healthcare, and financial services.

Our reputation for excellence is built on the expertise and dedication of our experienced team, which consistently drives our growth and success.

At Bridge Factor, we are more than just advisors – we are the connecting force that bridges opportunities with success. Let us show you how we make a difference.

“Bridge Factor is collaborating with Andersen Global in Pakistan”

7 USD Billion

Total Volume1+ USD Billion

On going TransactionsOur Service

Our comprehensive services include mergers & acquisitions, capital raising, strategic financial advisory, and power sector advisory.

Transactions History

Explore our portfolio of triumphs, featuring impactful mergers & acquisitions, transformative advisory projects, and bespoke financial solutions.

Waste to Energy Project

Advising a private sector client on the development of a ‘waste to energy’ project using organic municipal solid waste from the city of Karachi. Apart from methane abatement, the project is expected to have multiple social and environmental benefits for long term sustainability of the Karachi city.

Advising a private sector client on the development of a ‘waste to energy’ project

DHA Phase 8 Development Plan

Mandated to prepare an urban development plan for DHA Phase 8, Karachi.

Mandated to prepare an urban development

Fauji Solar Assembly Plant

Engaged to deliver a feasibility study for Pakistan’s first Solar assembly Plant.

Engaged to deliver a feasibility study for

DHA-Karachi

Conducting feasibility for EV charging stations, commercial towers, and a development of strategic plan.

Conducting feasibility for EV charging stations,

Pakistan International Airlines – Privatisation

Buy side advisory to one of the bidders (consortium of Fly Jinnah & Air Arabia) for acquisition of majority stake & management control of PIA. While the transaction remains un-concluded and currently proceeding to a fresh bidding process.

Buy side advisory to one of the bidders

Sustainable Energy and Economic Development (SEED) – Tourism

Mandated for transaction advisory services for the development of three Integrated Tourism Zones in KP under PPP mode. Services include financial modeling, transaction structuring and procurement process. Transaction value is USD 150 million.

Mandated for transaction advisory services for the development

Rehabilitation and Development of Water Distribution System in Sukkur

Transaction advisory services for rehabilitation and development of water distribution system in Sukkur under PPP mode . Scope includes transaction preparation, bid management; and closure.

Transaction advisory services for rehabilitation

NED Science and Technology Park

Appointed by Enertech Parks, a subsidiary of Kuwait Investment Authority, as the transaction advisors for the development of Pakistan’s first fully integrated Science and Technology Park being undertaken by the Government of Sindh under PPP mode.

Appointed by Enertech Parks, a subsidiary

Industries

Bridging industries toward a future of

innovation and sustainability

News & Events

Navigating the latest insights and trends in our news and articles hub.

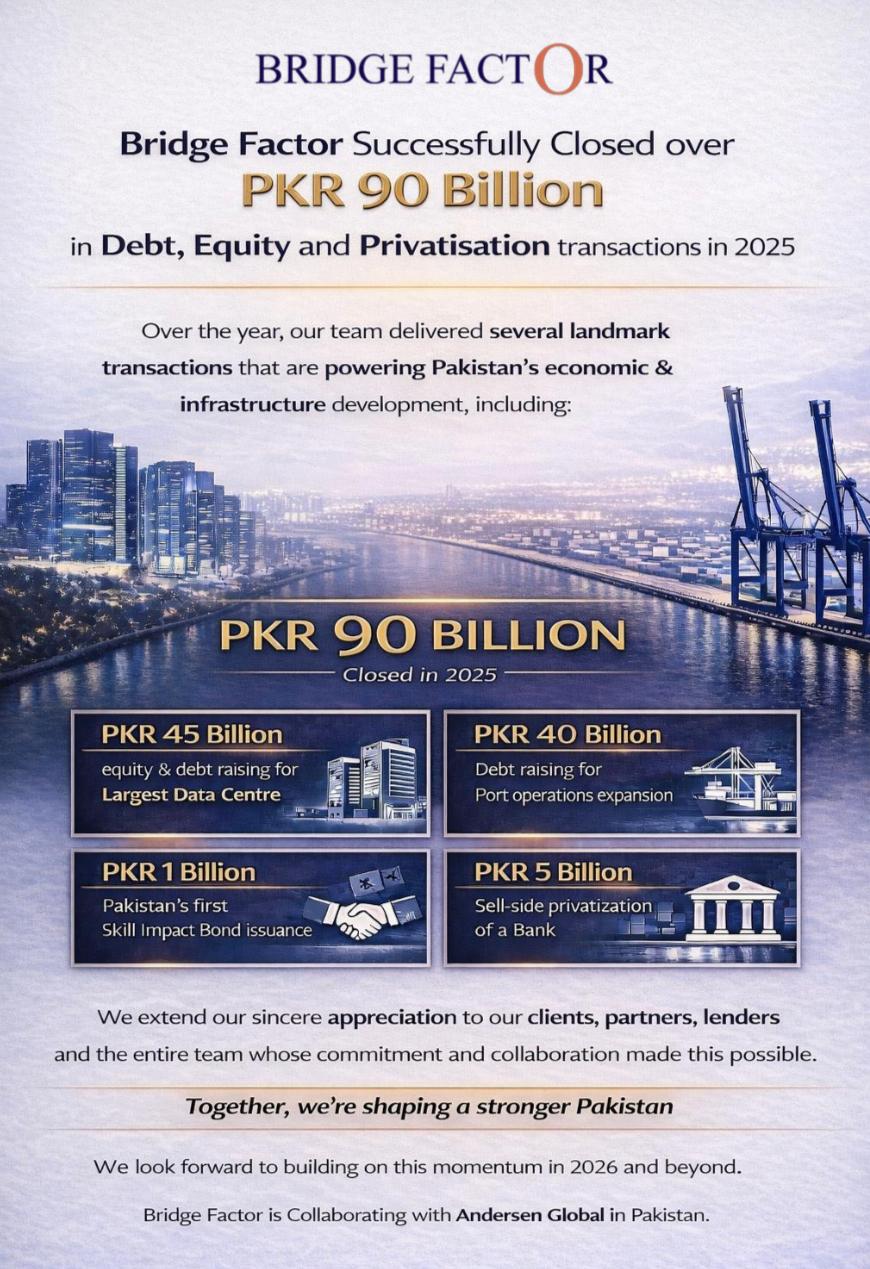

Bridge Factor successfully closed over PKR 90…

Bridge Factor successfully closed over PKR 90 Billion in Debt, Equity and Privatisation transactions in…

Bridge Factor acted as Transaction Advisor for…

Bridge Factor acted as Transaction Advisor for arrangement of Long term debt for the establishment…

Bridge Factor acted as Financial Advisor to…

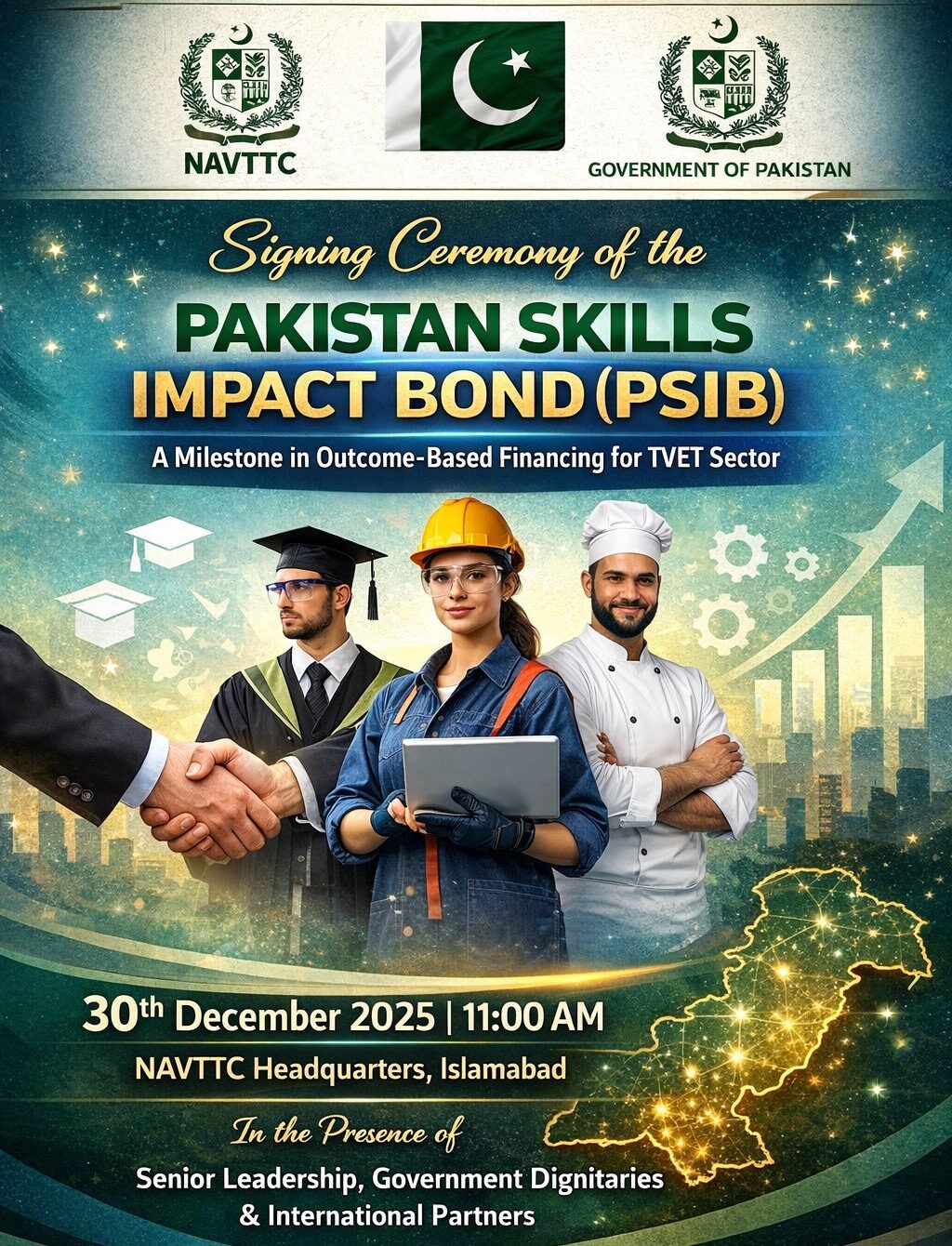

Bridge Factor acted as Financial Advisor to NAVTTC for issuance of first PKR 1 billion…